Results

We delivered pre-tax profits of US$1.075 billion to the Chilean State in 2015

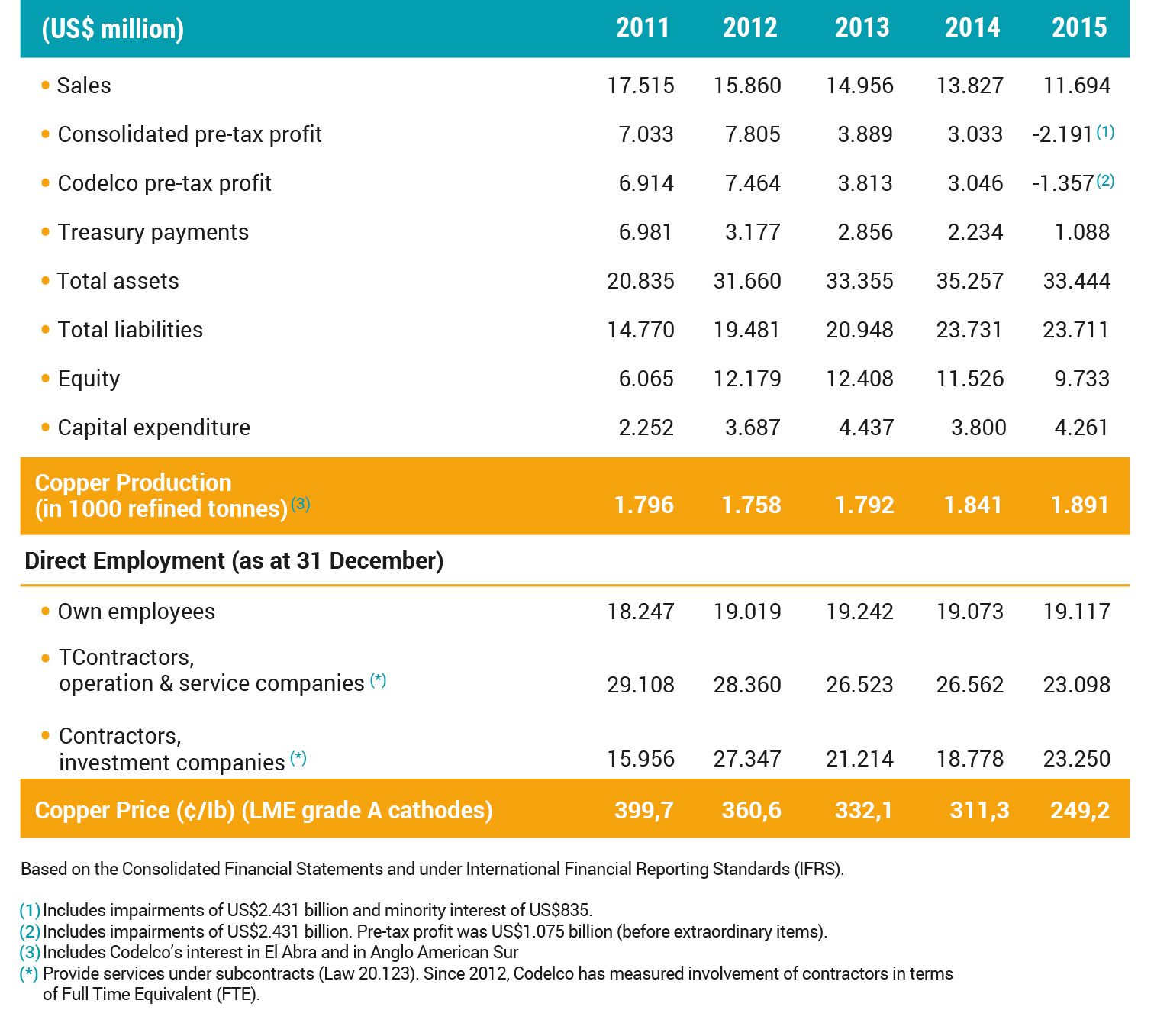

Key Perfomance Indicators

Economic-Financial Results

In 2015, we reduced costs and improved productivity, offsetting decline in copper prices.

In 2015, pre-tax profits were primarily affected by falling copper and by-products prices; but this was partially offset by the Company’s continuity plan, reducing costs and increasing productivity. Pre-tax profit refers to earnings before tax and Law 13,196 that levies a 10% tax on return on foreign sales of own-sourced copper and by-products.

Subsidiaries and Associates

We have a network of 52 subsidiaries and associates, to generate value for Codelco.

Codelco is a majority or minority shareholder in a network of companies and partnerships to create value.

Codelco has a network of subsidiaries and associates in different areas, such as mining, developers of new uses for copper, mining processing plants, research and technology companies and health institutions.