FINANCIAL-ECONOMIC RESULTS

Codelco generated US$ 7.033 billion in pre-tax profits in 2011, a 21% increase compared to US$ 5.799 billion in pre-tax profits in 2010.

Codelco's pre-tax profits correspond to results before income tax and Law 13,196 that imposes a 10% tax on returns from selling copper and by-products overseas.

Codelco's comparable profits- calculated by applying the same tax requirements as private companies - totalled US$ 5.253 billion, up 14% from the previous year, when it obtained US$ 4.605 billion. Therefore, once again Codelco was the most profitable company operating in Chile.

Copper and By-Product Prices

These record results are mainly explained by the positive price behaviour of most metals and products traded by Codelco.

The annual average price of copper in the London Metal Exchange rose to 399.7 US cents per pound, up nearly 17% over 2010, when it was quoted at 342.0 US cents per pound.

As for by-product prices, such as sulphuric acid, gold and silver, they were also positive compared to 2010. While in the case of molybdenum, the annual average price, according to Metals Week, experienced a slight fall from US$ 34.8 per kg in 2010 to US$ 34.2 per kg in 2011.

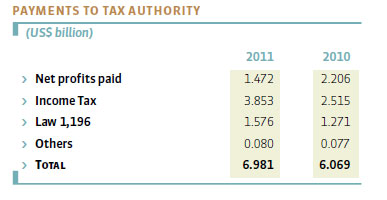

Contributions to Tax Authority

Codelco contributed US$ 6.981 billion to the Chilean Tax Authority in 2011, compared below:

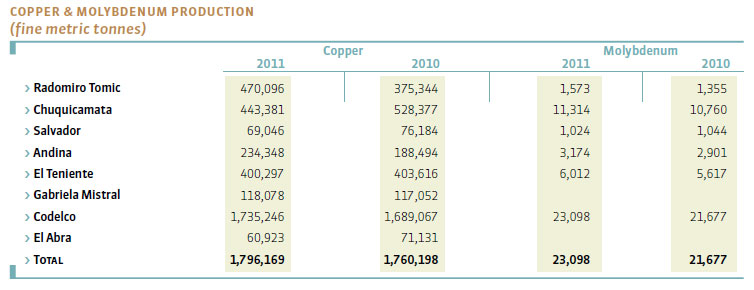

Record Production

Copper output at Codelco's own deposits increased to 1,735,000 tonnes of fine copper in 2011, up nearly 3% from the previous year. This figure is a record copper production in company history, higher than in 2004, when it produced 1,733,200 tonnes of fine copper, and an ore grade nearly 12% higher than in 2011.

The increased production compared to 2010 was mainly because more mineral was treated: 242 million tonnes were processed during the year, up 55% from 2010.

In this area Radomiro Tomic Division was the most outstanding; it produced a record amount of oxide ore. Andina Division also contributed to this increased production; towards the end of the year it reached the design capacity of the Andina-Phase I project.

While El Teniente Division maintained its production rate, despite an illegal contractor strike, between May and July, that lasted 55 days; this strike impacted production by 17,000 tonnes of fine copper, and cost the Company US$ 130 million.

Ventanas Division also maintained the same output as the previous year; while Chuquicamata Division reduced its own mineral production, which was in line with what had been planned and it reflects the depletion process of its open-pit mine.

Salvador Division's production was down mainly due to lower ore grades. While, the difficulties faced by Minera Gaby during the commissioning of its expansion project, prevented it from significantly exceeding the previous year's production; this situation was reverted and corrected towards the end of 2011.

If production related to Codelco's 49% interest in Minera El Abra is included, Codelco's total production was 1,796,169 metric tonnes of fine copper in 2011.

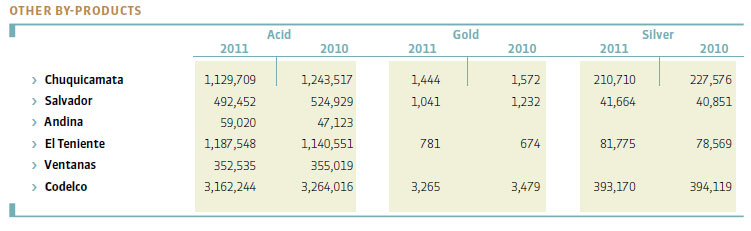

In relation to by-products, molybdenum production was 23,100 tonnes; sulphuric acid totalled 3.2 million tonnes, of which 57.5% was sold and the rest was used in Codelco's leaching operations. While precious metals, contained in anodic slime, totalled 3.3 tonnes of gold and 393 tonnes of silver.

Costs

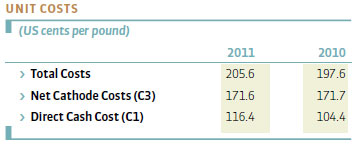

Total costs and expenses - including non-operating expenses - averaged US$ 205.6 cents per pound of copper produced, figure that is 8 US cents higher than in 2010. Therefore, and as the rest of the mining industry that operates in Chile, Codelco's costs were adversely affected by the significant strengthening of the Chilean peso against foreign currency and its impact on costs in local currency when expressed in US dollars.

A similar impact was caused by the increased prices of practically all inputs that have a significant effect on the cost structure, primarily energy and fuel.

Net cathode costs (cost C3), include net by-product credits and cathode treatment and refining costs of lower-added value production (such as copper concentrate and blister copper), were 171.6 US cents, similar figure to the 171.7 US cents in 2010.

Direct cash costs (cost C1) were 116.4 US cents per pound, i.e., up 12 cents from 2010. C1 costs are the type of cost that the mining industry uses to benchmark efficiency rates between different operations and companies. It represents the cost directly incurred in copper production and exclude non-operating expenses, such as depreciation and amortisation. The increase in C1 cost was primarily due to the abovementioned external factors.

FINANCING

Codelco regularly has access to domestic and international capital markets to help fund its investments. This has enabled it to develop an extensive and geographically diversified base of financial institutions that invest in the debt instruments issued by the Company. Hence, the Company has had access to American, Asian and European capital markets, through bond sales and syndicated and bilateral loans.

In 2011, Codelco carried out financing operations totalling US$2 billion to finance liabilities and anticipate a significant part of its investment funding for 2012. These operations consisted in issuing a US$ 1.15 billion bond and negotiating 5-year bilateral loans for US$ 850 million, with bullet maturity. The 10-year bonds issued on the international market for US$ 1.15 billion is a record figure in company history and the bonds were issued to refinance liabilities and anticipate a significant part of the funding required for investments that will be implemented next year. The conditions obtained - a total yield of 4.048% p.a. and annual coupon of 3.875% - are among the historical rates obtained by Codelco and reflect the recognition of Chile and the Company, despite the volatility of international financial markets. The transaction was nearly three times oversubscribed and more than 150 investors participated. Fund administrators, insurance companies and pension funds accounted for 73% of the demand, while banks and hedge funds accounted for the remaining 27%. The geographical distribution was 68% in the United States; 23% in Europe, 6% in Latin America and 3% in Asia and the Middle East. The bond sale was arranged by HSBC bank and Mitsubishi UFJ Securities.

In January 2011, the Board authorised Codelco to sell its minority interest in E-CL S.A. and retain earnings from this operation. The sale was for more than US$ 1 billion.

In June 2011, the capitalisation of 2010 profits was approved totalling US$ 376 million, approximately 20% of the profits obtained in 2010.

Risk Management

Copper Prices

Copper prices significantly affect Codelco's financial performance. The Company's strategy to face these fluctuations is to ensure and maintain a cost-efficient and competitive structure. Hence, in recent years the Company has carried out price hedging operations for its production.

The Company regularly uses derivative instruments to ensure its shipments are sold at market prices effective during the months specified in Codelco's price policy applicable to each product. Derivative operations do not involve speculative operations.

Exchange Rates and Interest Rates

Codelco has defined policies to cover exchange rate risk and interest rate fluctuations. Foreign exchange hedging includes exchange insurance for future fluctuations in UF (inflation indexed peso)/US dollar; while interest rate hedging involves contracts to set rates for future obligations. These operations do not include speculative operations.

Insurance

Codelco has all its assets, employees and potential business interruption permanently insured.

Insured Assets

All facilities used for its main business activity in Chilean territory.

Risk Rating

Codelco is analysed and its debt assessed by four credit rating agencies: Fitch Ratings, Feller-Rate, Standard & Poor's and Moody's. In 2011, Codelco maintained its investment-grade credit rating for its foreign debt: A1 by Moody's; and A, by Standard & Poor's. In the case of local debt, Codelco has AAA rating, both by Fitch Ratings and Feller-Rate.

The Company has been registered since 2002 with the Superintendency of Securities and Insurance (SVS) in Chile.