Over the last five years China has become Codelco�s main customer, especially after the subprime crisis, when the Company�s traditional niches � America, Europe, Korea and Taiwan � were significantly affected by financial difficulties and had less industrial activity.

In 2011, despite financial instability in Europe, Codelco managed to establish a more balanced distribution in its global markets, after recovering part of the tonnage it sold to traditional destinations. Therefore, during 2011, 32% of Codelco�s refined copper sales were delivered to China; followed by Europe with 27%; the rest of Asia with 21%, and both South America and North America with 10% each.

A relevant market during this period was Japan that, after the earthquake and tsunami that affected this country at the beginning of the year, generated a strong copper demand caused by a decline in production at Japanese smelters affected by the catastrophe. Several Japanese consumers and producers purchased significant tonnage to cover their requirements, which increase Codelco�s sales to this nation and strengthened the relationship Japan has historically had with Codelco.

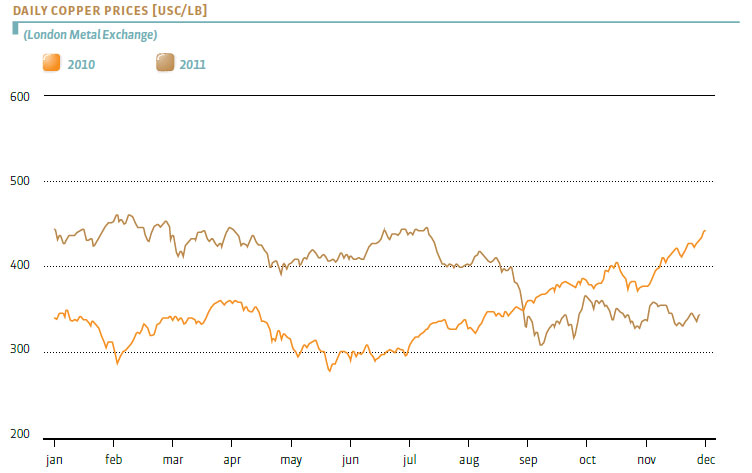

Copper Prices

In 2011, the average price of copper reached 399.7 US cents per pound, which is the highest average price in one year since records have been kept at the London Metal Exchange. In 2010 the average price was 342 US cents per pound.

The biggest rise in prices occurred during the January- August period when the average price reached 425 US cents per pound; while, the average price during the September-December period was 351 US cents per pound. As of September, the main systemic risk in Europe dampened copper demand expectations given the potential impact on China�s growth.

In December, several indicators generated a positive change in expectations on copper price trends, such as China�s GDP growth during the last quarter of 2011, the upward trend of copper imports and the announcement that internal credit restrictions would be lifted.

Furthermore, Europe adopted measures tending to limit the effects of the debt crisis; while the North American market maintained its slow, but stable recovery.

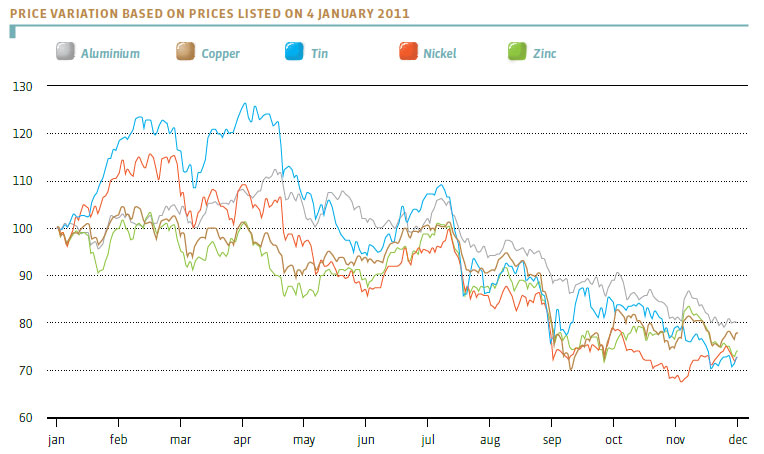

All base metals traded on the London Metal Exchange had a similar behaviour in 2011. There were overall price falls during the year, but it ended with metal prices dropping 20% and 30%.

Historically, copper and aluminium price ratio has maintained a 2:1 ratio. However, copper prices in 2011 underwent fluctuations at about four times the price of aluminium, substitute material for the red metal in its main markets. The significant difference of copper versus aluminium prices increases the risk of substitution, threatening a downturn in copper demand.

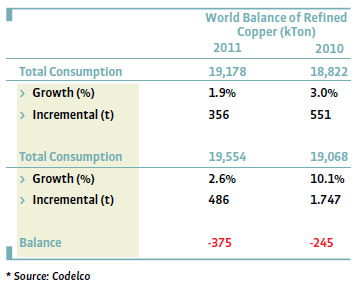

In 2010 and 2011, growth of refined copper production has been less than expected. Copper demand is mainly sustained by its growth in China. As a result, balances show deficits caused by high prices.

Sales

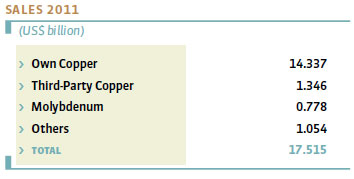

Total sales revenue from copper, by-products and copper processing services was US$ 17.515 billion in 2011. Copper represents 90% of total sales and by-products 10%.

Revenues from own and third-party copper sales totalled US$ 15.683 billion, which corresponds to a total 2 million metric tonnes.

In sales, the item �Others� includes anode slime, sulphuric acid, precious metals and revenues from copper processing services.

By-products sales added US$ 1.832 billion to Codelco revenues, of which US$ 778 million correspond to molybdenum and US$ 1.054 million to anode slime, sulphuric acid and precious metal sales and copper processing services.

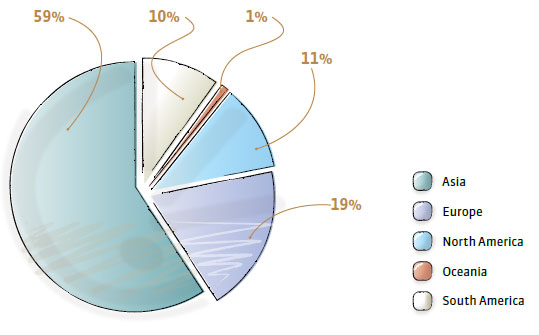

Asia is the most important sales market for Codelco with 59%, followed by Europe with 19%. South America and North America represent 21%, with 10% and 11%, respectively.

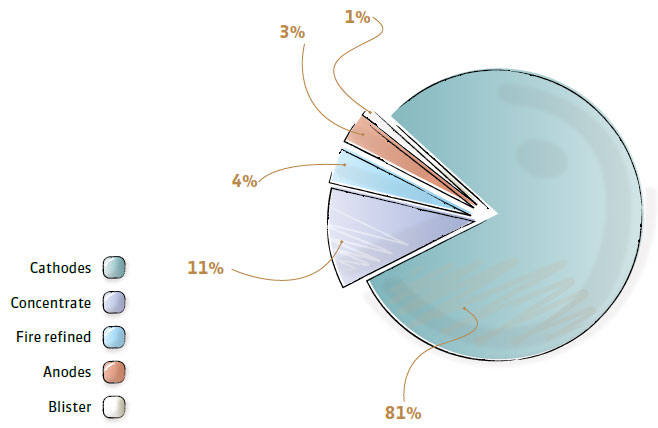

81% of copper sales are cathodes which makes Codelco the biggest world producer of cathodes. Non-processed concentrate surplus at Codelco smelters is sold and accounts for 11% of sales. 2011 marked the end of fire refined copper production, which represented 4%.